Range accrual notes

What are range accrual notes?

Range accrual notes are interest rate linked structured notes that provide investors the opportunity to receive a variable coupon if a reference interest rate stays within a pre-defined range through the term of the notes, with the principal amount being repaid at maturity. They offer the potential to earn enhanced yields over traditional fixed income products.

How do they work?

Range accrual notes have a start date and a maturity date with a series of observation dates called determination dates. The notes will accrue interest on each determination date if the reference rate is in a pre-defined range during each interest period.

The notes are fixed term products that are intended to be held to maturity. There are two key features to understand with this product:

- The reference range

- The determination frequency

The reference range

Whether the note will pay a coupon, and how much each coupon is, depends on how many determination dates the reference rate is within the reference range in a coupon period.

On each determination date during a coupon period, if the range condition is met, the note will accrue interest for that date. If the range condition is not met, then interest does not accrue for that date. Throughout each interest period, the coupon is calculated based on the number of determination dates where the range condition is met.

Range accrual notes can be linked to a variety of interest rate benchmarks, but most commonly, SOFR (Secured Overnight Funding Rate) is used for USD and CORRA (Canadian Overnight Repo Rate Average) is used for CAD.

Determination date and payment frequency

Range accrual notes can be customized with different determination date frequencies and payment frequencies. Most commonly, these products have daily determination dates and quarterly or semi-annual interest payment dates.

Range accrual notes can be customized with different determination date frequencies and payment frequencies. Most commonly, these products have daily determination dates and quarterly or semi-annual interest payment dates.

Illustrative scenarios

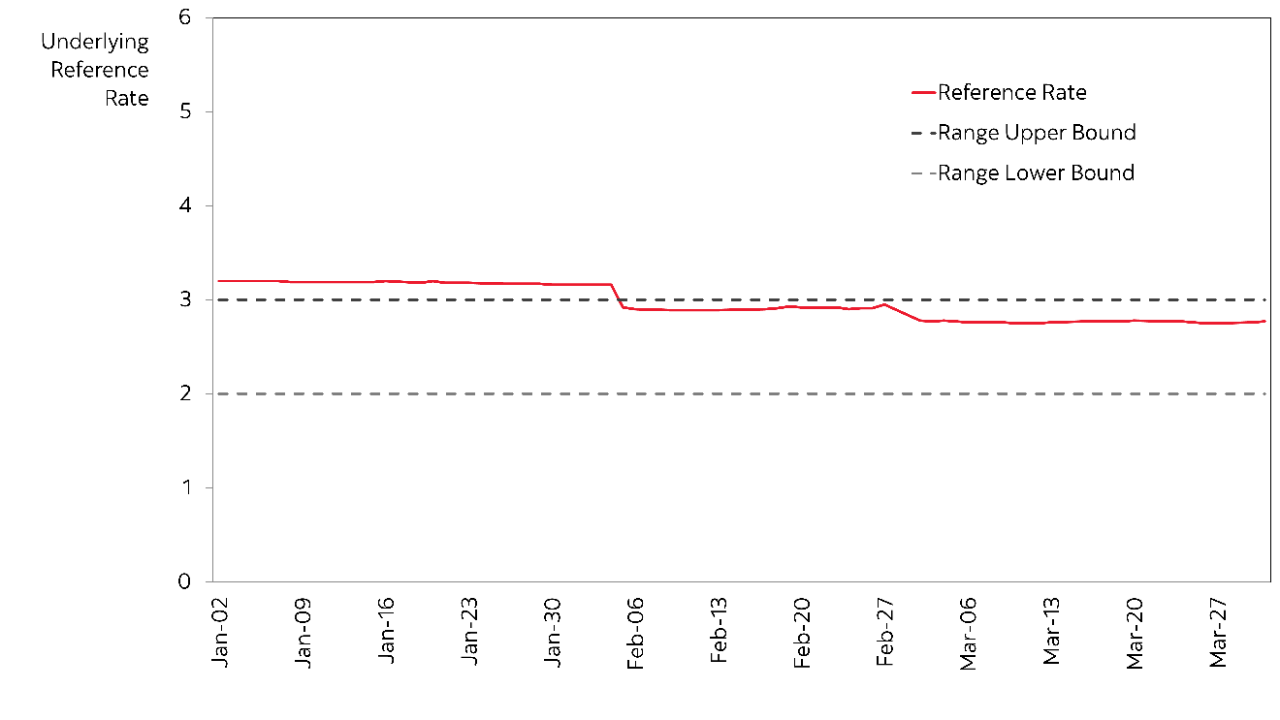

For each of the following scenarios, we’ll use a hypothetical 2-year note paying a coupon of up to 5% if the reference rate, CORRA, is in the range of 2.00% and 3.00%, inclusive with daily determination dates and quarterly interest payments.

Scenario 1:

The reference rate is out of range for all determination dates in an interest period. In the first scenario, the reference rate remains out of the reference range of 2.00% and 3.00% inclusive for the entire interest period of 90 days. The coupon payment will be calculated as follows:

Number of days the reference rate is in range: 0

$100.00 × 5.00% × 0/90× (90/360) = $0.00

Total quarterly coupon payment: $0.00

For every $100 of principal, the investor receives no coupon payment for this period.

Scenario 2:

The reference rate is in the reference range for 54 out of 90 determination dates in an interest period. In the second scenario, the reference rate remains within the reference range of 2.00% and 3.00% inclusive for 54 out of 90 determination dates in the interest period. The coupon payment will be calculated as follows:

Number of days the reference rate is in range: 54

$100.00 × 5.00% × 54/90× (90/360) = $0.75

Total quarterly coupon payment: $0.75

For every $100 of principal, the investor receives a coupon payment of $0.75 for this period.

Scenario 3:

The reference rate is in range for all days in an interest period. In the third scenario, the reference rate remains within the reference range of 2.00% and 3.00% inclusive for the entire interest period of 90 days. The coupon payment will be calculated as follows:

Number of days the reference rate is in the reference range: 90

$100.00 × 5.00% × 90/90× (90/360) = $1.25

Total quarterly coupon payment: $1.25

For every $100 of principal, the investor receives a coupon payment of $1.25 for this period.

When to consider range accruals

A range accrual note may be suitable for an investor who has a view on the interest rate curve. These products can be customized to fit a specific market outlook.

Cash flow needs

Range accrual notes are designed to provide periodic cash flows, however these cash flows are contingent on the defined range condition being met. These products can be customized to fit an investor’s payment schedule needs.

Term preference and secondary market

Range accrual notes are fixed term products intended to be held to maturity. Investors can choose to match the maturity of the note with their needs with respect to investment time horizon. A sale of a note in the secondary market may be subject to an early trading fee, or loss on the principal amount invested, or both.

Potential Benefits of range accrual notes

- Possibility for Enhanced returns: Opportunity for a higher yield compared to other fixed income products with a similar credit risk and term to maturity.

- Customization: Range accrual notes can be tailored to express an outlook on the interest rate curve with varying levels of risk tolerance.

- Hedging instrument: Can be used as a vehicle to hedge fixed income and equity exposure on a portfolio level.

- Principal repayment: 100% of the principal invested is repaid on maturity.

Risk of range accrual notes

- Variable return not guaranteed: The investor may receive a coupon that is less than what could be earned with a traditional fixed income product.

- Credit risk: The notes are debt obligations of The Bank of Nova Scotia and are subject to the Bank’s creditworthiness.

- Market risk: How well a structured note performs depends on many factors related to how the reference rate performs in the financial markets.

- Interest rate risk: The secondary market price of the notes is sensitive to changes in benchmark interest rates.

- Expiry considerations: Investors should know their investment time horizon and select a note with an appropriate term.

- Tax considerations: Investing in structured notes may have tax implications to the investor. Investors should obtain their own tax advice.

- CDIC considerations: Except for market linked GICs, structured notes are not eligible for insurance by the Canada Deposit Insurance Corporation.

- Benchmark rate volatility: Daily changes in some interest rate benchmarks may be on occasion, more volatile than changes in other benchmark or market rates.

- Currency risk: Investors may bear foreign exchange related risk if the return on the notes is denominated in USD and their other assets or income are denominated in another currency, such as the Canadian dollar.