US retail sales are set to get a boost from the $1.9-trillion USD stimulus package as cheques arrive in US mailboxes. As well, spring weather, the rollout of vaccines and easing of restrictions should make US consumers more comfortable heading to malls and shops to spend some of the cash they tucked away during the pandemic. With global growth set to accelerate for similar reasons, GDP forecasts have been pushed upward pretty much globally, except in the Eurozone, which is still experiencing lockdowns due to COVID-19. That strong growth will turbocharge revenue and earnings growth over the next couple of years, which should support equities. Meanwhile, housing sales across much of Canada hit another record in February, which was accompanied by a rise in new listings. The loonie, underpinned by strong economic data and positive interest rate differentials, has performed well of late but a third wave of COVID and a slow vaccine rollout could be a risk to its near-term outlook.

Scotiabank analysts weigh in on what the pandemic means for retail, equities, housing and foreign exchange.

Retail

- The signing into law last week of the $1.9-trillion USD coronavirus aid plan is expected to seriously stimulate retail sales this spring as these federal stimulus checks arrive in US households. Many Americans will receive cash payments of $1,400. The arrival of spring will prove an additional catalyst to spend. Should we also see an easing of restrictions as vaccines roll out, consumers will be more willing to go to malls, retail shops and spend in the hospitality sector. The pickup in jobs in the US in February with 379,000 added to the workforce provides an added tailwind. With US consumers adding to savings through the pandemic there is incremental purchasing power available.

- The most recent Department of Commerce data released this week show a decline of 3% for retail sales in February. This marks a reversal of the trend evident in January, which has been revised to a 7.6% increase. Retail sales for the past three months were up 6%. The February decline likely reflects the severe winter weather across many parts of the United States, which impacted the ability to shop. Consumers spent less on autos, furniture, electronics, home improvement, healthcare and clothing. Sales at food and beverage stores were flat while sales at gas stations rose 3.6%.

- The risk to the more optimistic outlook for consumer spending in this important market is the possibility of any potential resurgence in infection rates. As a number of states and municipalities have relaxed restrictions, there is concern in some circles that this may lead to another COVID wave. All eyes will be on states such as Florida, currently experiencing an influx of “spring breakers,” and Texas and Mississippi, which announced they would drop mask mandates at the beginning of March. The decision was widely criticized by health experts. Despite this, nearly every state has announced a roll back of restrictions. We have to hope that the potential for the economic recovery and boost for retailers that could come from the stimulus package and cash in people’s hands doesn’t get derailed by the removal of the careful behaviour in masking and hand washing.

— Patricia Baker, Director, Retailing, Global Equity Research

Foreign Exchange

- The Canadian dollar (CAD) is the best performing currency against a (mostly) firmer US dollar (USD) since the start of the year. The bulk of the CAD’s 2% or so year-to-date gain, which has taken it to a three-year high versus the USD, has developed since the start of March. That reflects improving economic data and the market’s belief that better-than-expected growth late last year and so far in 2021 means that Bank of Canada (BoC) might start to pare back asset purchases as early as the April policy meeting. Domestic interest rates have firmed and yields at the short end and belly of the curve have risen above similar US bond yields.

- Positive interest rate differentials have helped underpin CAD gains alongside relatively firm commodity prices. Crude oil responded positively to the OPEC+ decision to maintain output curbs through April. However, commodities generally remain elevated, with the Bloomberg Commodity Index holding around its highest level since late 2018. This combination of factors suggests the CAD is well-supported from a fundamental point of view. Even if market speculation of potential rate increases in Canada in early 2022 looks very premature (Scotiabank expects the BoC to remain on hold until late 2022), the potential for the BoC to start tapering asset purchases in the not too distant future contrasts with increased bond buys at the European Central Bank and the Reserve Bank of Australia and steady policy settings at the Federal Reserve, Bank of Japan and Bank of England.

- There are risks to the CAD outlook near-term, however. Canada’s domestic vaccination program is lagging many of its peers, which might yet curb the economic rebound as third wave worries mount. Also, the CAD’s sharp gains in the past few weeks could leave it looking overbought and prone to a correction against the USD from a technical point of view. We think moderate USD gains are liable to attract renewed USD selling interest, however, and we note that more broadly the USD is nearing a period of the year where it typically softens. We continue to forecast USD/CAD easing to 1.23 in the second half of the year.

— Shaun Osborne, Managing Director, Chief FX Strategist, and Juan Manuel Herrera, FX Strategist

Housing

- Another robust month for Canada’s housing market. The stronger-than-expected trend in the housing market witnessed throughout 2020 shows no sign of slowing despite the lockdown measures put in place early this year. Last month’s jump in home sales across much of Canada set another record, but it was accompanied by a welcome increase in listings. Home sales for February rose 6.6% from the previous month, while listings rebounded 15.7% month-over-month. The national-level sales-to-new listings fell to 84% from the record reading of 91% in January in which all the markets we track recorded their highest ratio on record.

- Buyers continue to demonstrate a preference for more space as the pandemic and its impact on living and working conditions persist—with two-storey single-family homes driving the increase in price. The composite MLS Home Price Index (HPI) rose 3.3% (m/m), reflecting the sharp increase the sales-to-listing ratio has seen in recent months.

- Even as the risks for a third wave and virus variants remain, there are signs of strong recovery and economic growth this year, which will add steam to housing demand. Data shows very robust GDP growth that might recover COVID losses and close the output gap by year’s end, as well as Canadian job gains in February that almost recouped all the losses of the second wave lockdowns. Housing sales should get a further boost from acceleration in vaccine rollouts in Canada and the US; the effects of the massive US fiscal stimulus and expected additional stimulus in Canada’s spring federal budget; and Canada’s increased immigration targets, although the latter will depend on global vaccination progress and the removal of border restrictions.

—Farah Omran, Economist and Raffi Ghazarian, Senior Economic Analyst

Equities

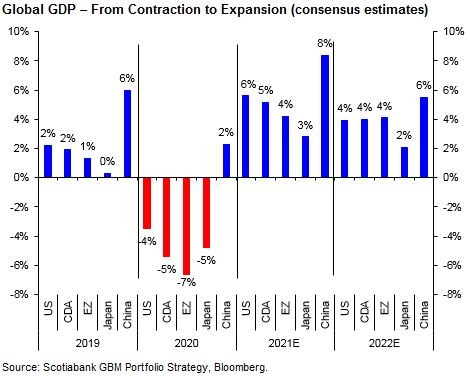

- En route to the strongest pace of expansion since the 1980s. After a painful 2020, GDP growth is set to accelerate strongly around the world this year. Pillars of growth are well-known: excess liquidity, huge monetary and fiscal support, lockdowns abating, and vaccinations accelerating. The freshly adopted $1.9-trillion USD stimulus fallout from the Biden administration should put growth on an even faster track and economists have been busy revising their forecasts upward recently. U.S. GDP growth forecasts have been revised +70 bp higher in the past month and +170 bp in the past three months. In fact, GDP forecasts have been pushed upward pretty much globally, except in the Eurozone, which is still experiencing lockdowns due to COVID-19.

- The U.S. economy is poised to grow at a 5.6% clip in 2021 (as flagged in the chart below), according to consensus forecasts, which would mark its strongest expansion since 1983. Scotiabank Economics is even more bullish, pegging U.S. GDP growth at 6.3% this year. Moreover, an above-trend increase (+3.9%) is also forecasted to expand to 2022. By means of comparison, the rebound after the financial crisis occurred in smaller amplitude (+2.6%) in 2010 and was followed by a scant 1.6% the year after. Canada is also expected to rebound strongly, with consensus calling for GDP growth of 5.2% this year and 4.0% next year. As we pointed out over the past several months, strong growth will turbocharge revenue and earnings growth over the next couple of years, which should support equities (with equity returns being driven more by earnings than P/E)

— Hugo Ste-Marie, Director Portfolio & Quantitative Strategy; Jean-Michel Gauthier, Associate Director, Portfolio & Quantitative Strategy; and Simone Arel, Research Associate, Global Equity Research

For Scotiabank, Global Banking and Markets Research Analyst Standards and Disclosure Policies, please visit www.gbm.scotiabank.com/disclosures.